How do you calculate a perfect sale price for your next campaign? Running a sale like Black Friday to boost your product sales is often tempting. Earlier on, previous campaign results and estimated outcomes were enough to make a solid plan for the next sale. You probably used the same approach, most likely, every time. However, as the EU’s new Omnibus Directive is in force, the legal requirements mean you must change how you prepare for sale campaigns. You must also change the way you plan your sale price. We decided to study the difference between two approaches on pricing to create a stellar sale campaign. We used the demand models used by our AI to enable as accurate a forecast model as possible.

The background for the sale price simulation

As said above, we base our simulation on actual demand. As the product, we are selling a chair. A light wooden chair called creatively Light Wooden Chair.

The original price we brought to market was 500€, and now the price is 450€. We use that as a given premise in both cases. Firstly, we are 31 days from the 30-day discount campaign. That is why, we must decide whether to raise the price higher to get a better comparison price (Omnibus Directive regulation) or use a lower price to start the sale.

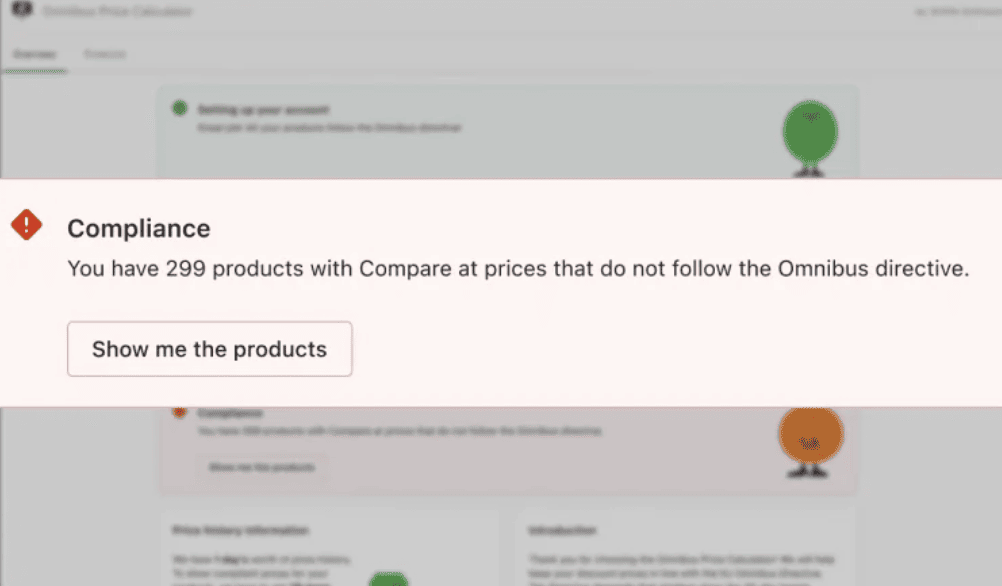

The simulation considers in both scenarios Omnibus Directive and will comply with that legislation. We will go to that at the end of the blog post. But now, we must decide on the market we are in and select the price sensitivity of our customers.

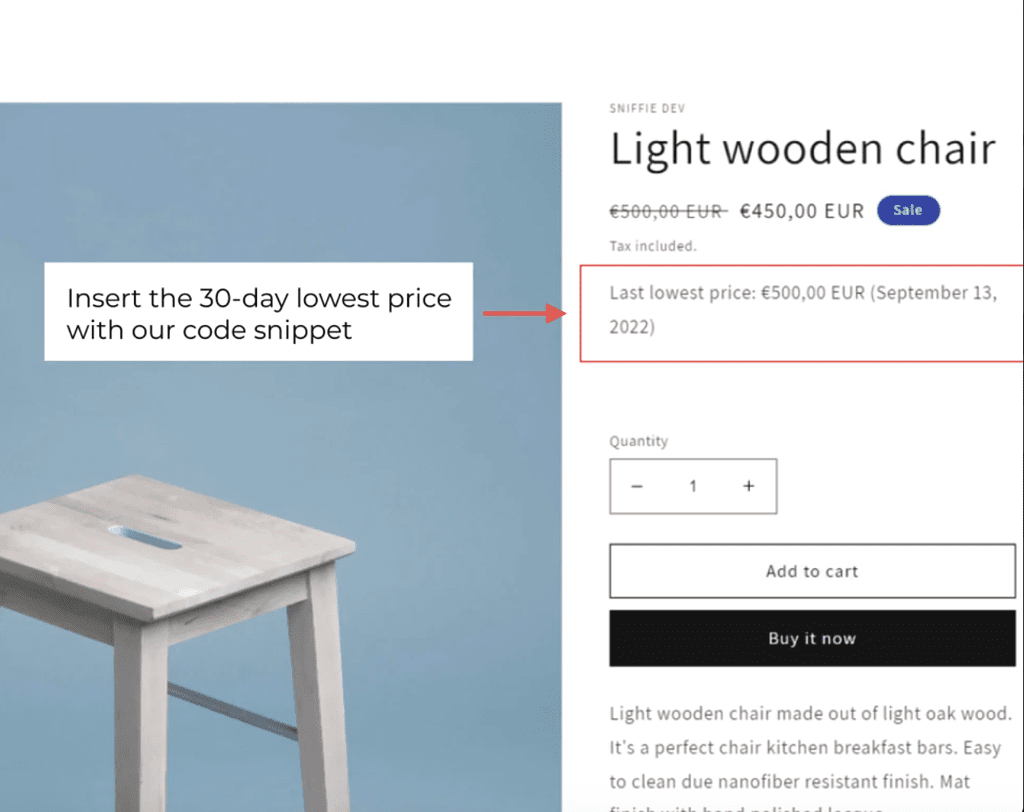

Show your Omnibus price automatically

We keep an eye on the lowest prices for 30 days and dynamically show them on your website. Show off your discounted pricing with confidence!

Determining the customer profile first

As pricing highly depends on your customers’ price sensitivity, we will consider that as the starting point. In case multiple retailers are selling the same products around the internet, it is more likely that your customers will look for the lowest option.

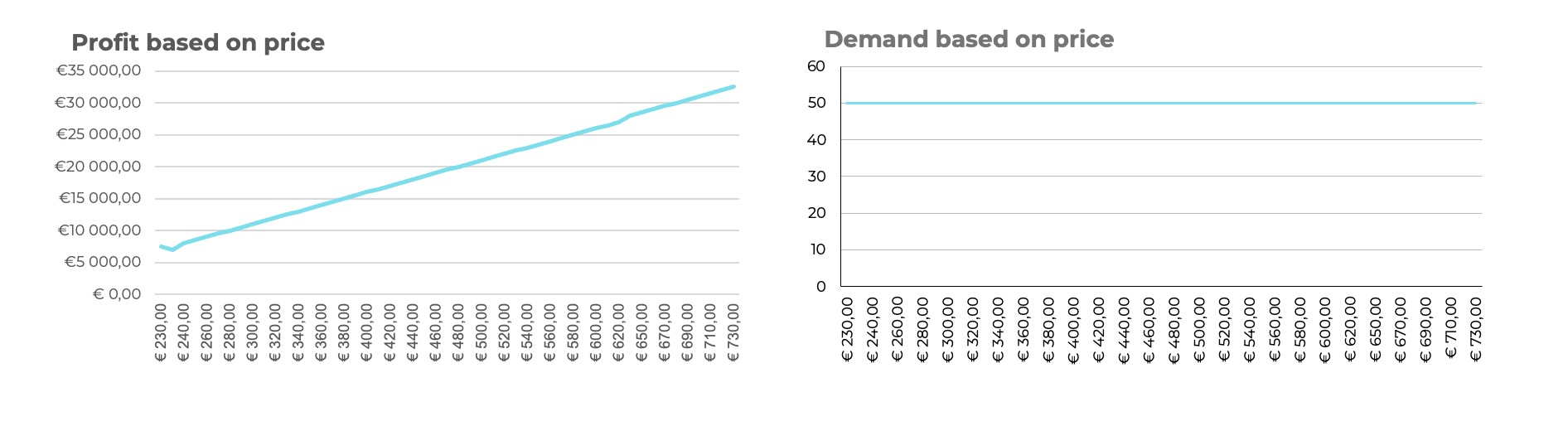

To make this simulation real, we used aggregated data from Sniffie AI to create five different customer profiles (Sniffie demand function). The price sensitivity takes into account the market competition as well. The more competed the market is, the higher sensitivity you should choose. The more options there are on the market, the more possibilities consumers can choose from. The customer profiles based on price sensitivity use price elasticity: (see also: Price elasticity basics: Understand the Strategic Pricing Gateway)

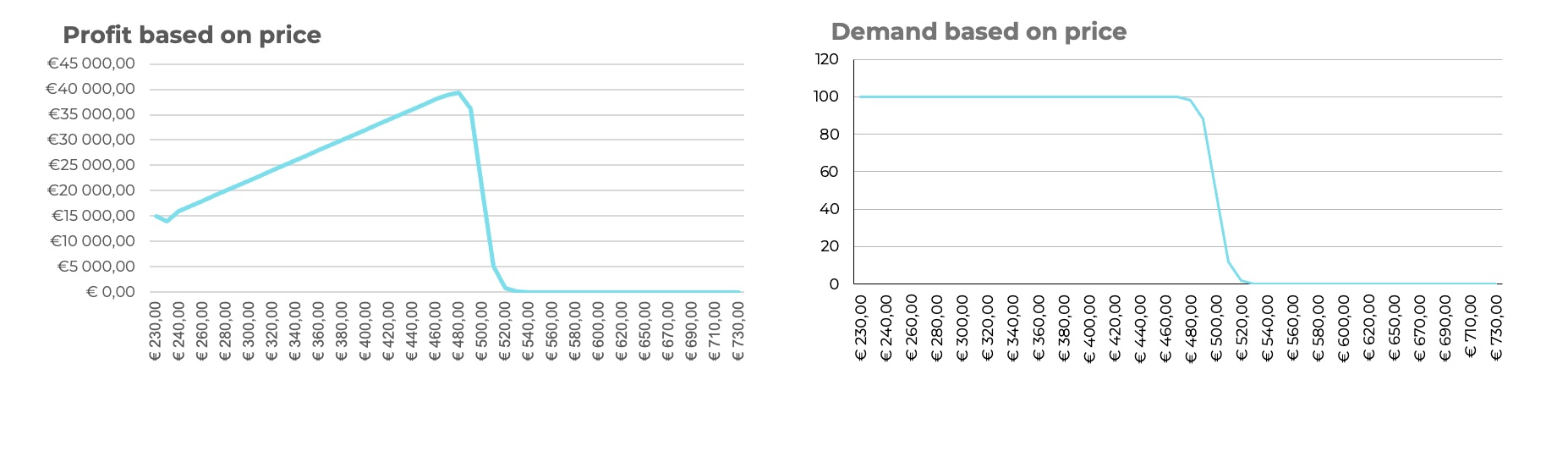

1. Extremely price sensitive customers

For these customers, the price is of utmost importance. They know the market and price and compare every purchase from multiple retailers. They love a good deal. So for them, your promise of a low price makes no difference unless it’s true. You can see the demand and profit curves below every profile against the cost of our product.

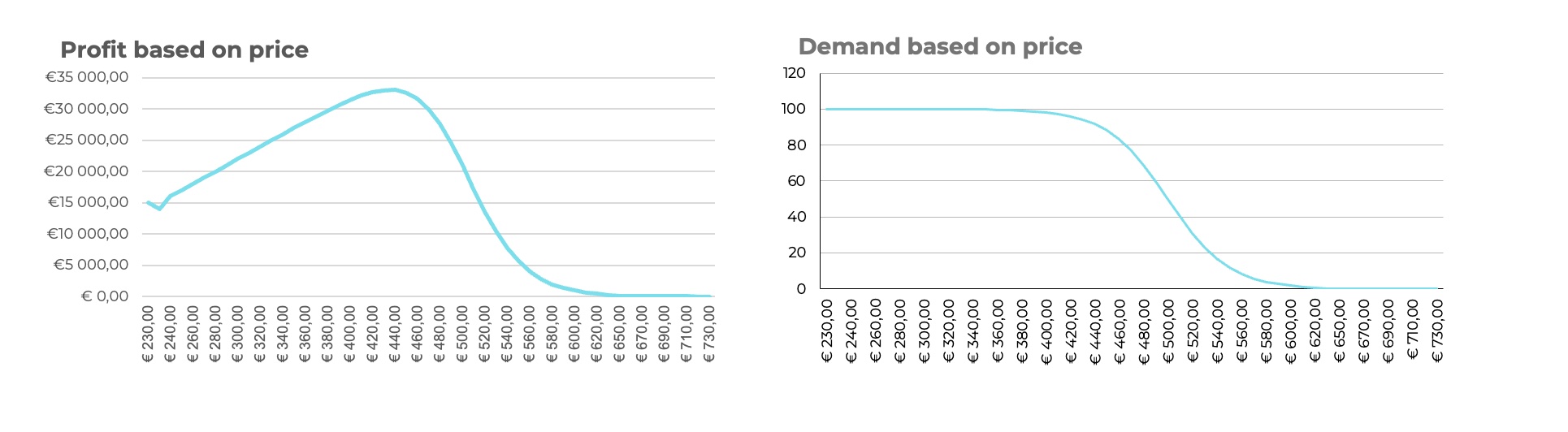

2. Very price sensitive customers

For this segment, price plays an important part. Because they know the market price, a more negligible price difference will make them buy elsewhere.

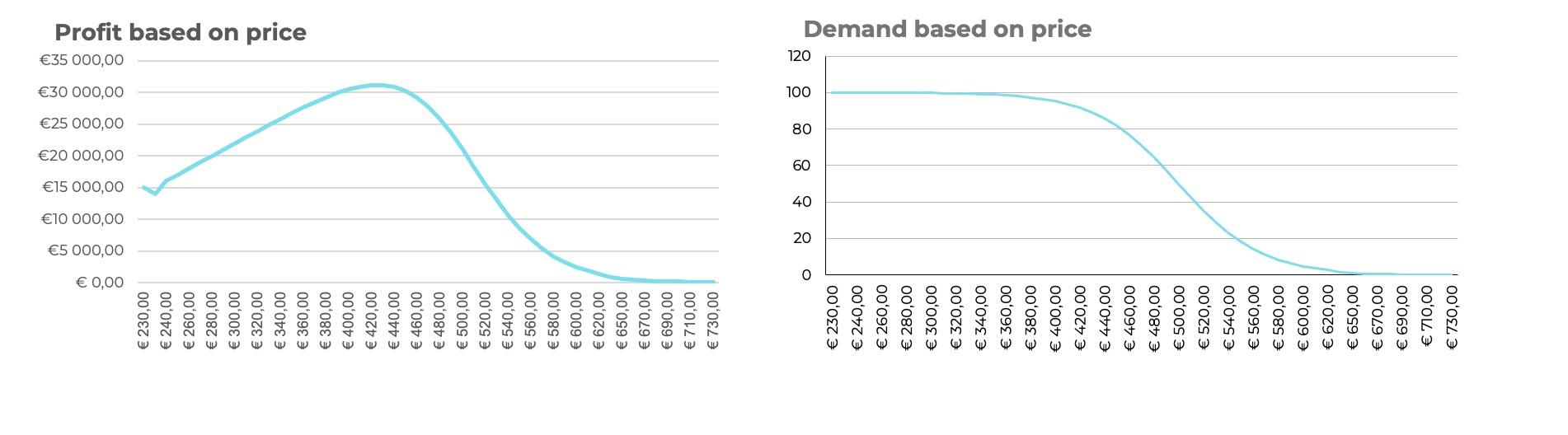

3. Price sensitive customers

For these customers, price is essential but not the only thing they consider in their purchase decision. They might appreciate fast delivery, good reviews, branding, earlier purchases etc.

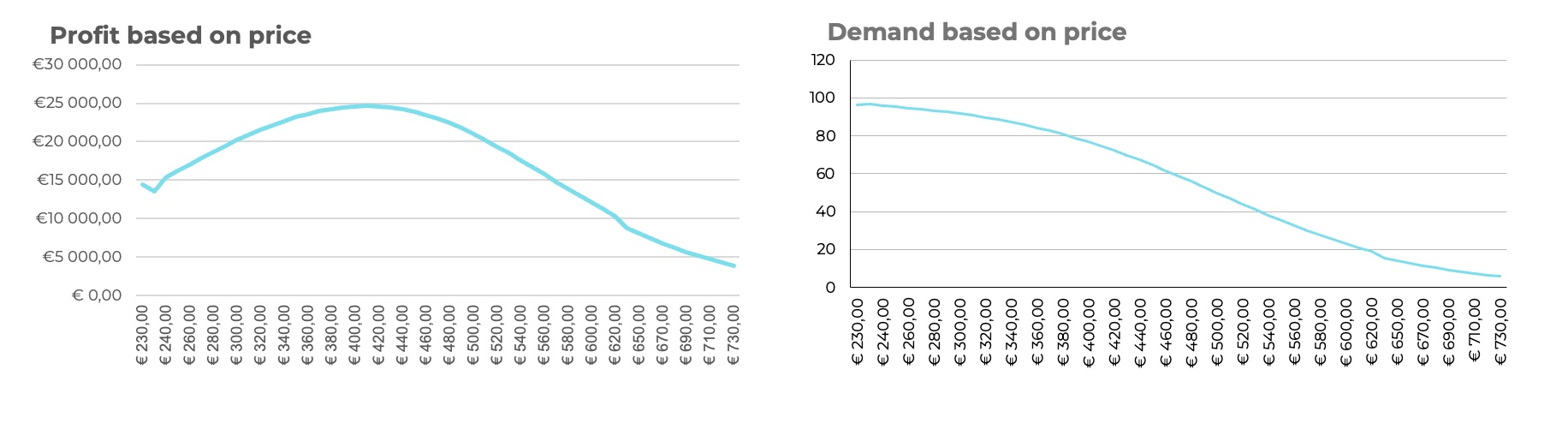

4. Price affects very little to these customers

These customers do not care about the price. They love shopping for products on impulse or from the same retailer. They also care more about the saved time on fast shopping experience and delivery than the actual sale price.

5. Price has no effect to these customers

For these customers, it is irrelevant what they pay for your products. So naturally, for this simulation, we will consider the above examples. An example of this type of product is a Ferrari. On the contrary, people buying a Ferrari might love the fact that it costs more. Then they know fewer people are driving those.

Use Our Free Price Elasticity Calculator

Use this simple calculator to calculate your product’s price elasticity and understand how price changes affect your product’s demand.

Specifying the sale price before the sale

As Omnibus Directive requires us to show the 30-day lowest price before the campaign, the comparison price and discount percentage will play a part. According to studies, the minimum discount should be at least 5%. The minimum does not sound like a discount but still is the lowest amount, attracting customers’ attention. Therefore, it would be best if you chose the discount’s upper limit by evaluating our campaign’s cost structure and aim. In this example, our costs are only 18% of our price (450€), which gives us great flexibility when designing the on sale price.

Let’s assume we aim to create as much profit as possible and clear stock to make room for newer models. For this example, we evaluate that we want our minimum margin to be around 160€ price point, and to clear stock, we want the minimum sale percentage to be at least 30%. The 30% we have learned by analyzing previous sales. These premises paint our range of possible sale percentages to 30% – 64%.

Note that the discount will cut our margin more than it cuts the price the customer has to pay. So in this example, giving a 50% discount from 450€ for the customer cuts our margin by roughly 60%.

In these scenarios, we also assume that we are not the only ones selling light wooden chairs. According to studies, this makes our customers more price sensitive. Based on studies, we can also assume that since we are an eCommerce company, the customers respond better to “30% cheaper than market” signs than to “30% discount from our previous price”. This encourages us to focus our marketing more on the discount from the market price than the discount percentage from our original price.

The question is: What is the best price for the 31 days before the campaign? How will that affect the overall profitability of our sale campaign?

We will lose sales in the previous 30 days if we have a very price-sensitive market. So to cover that, we need to understand the impact of the price change before the sale campaign.

Selecting the sale campaign discount %

A successful sales campaign depends highly on how good deals you can provide—knowing your purchase price, demand from earlier campaigns and your marketing budget, the questions are:

What will be the best sale discount % in your upcoming campaign?

What is the best option for the sale to be as profitable for us as possible?

Finally, before you make the decision you could use two thumb rules. First, the percentage should be more than 30% (see above the explanation) and the end price inline with other sale prices on the market.

To see the difference, we will compare the two scenarios and think about how realistic those are for us.

Returning to normal pricing after sale campaign

We are naturally returning our pricing to normal, which also needs some consideration. For example, what should be the regular price of our product after the sale? We again examine the price impact on the overall profitability 30 days after the sale. Many eCommerce companies use dynamic pricing, so this issue might be something they consider more on the gateway they give the pricing engine to set the prices.

Running the sale price simulation

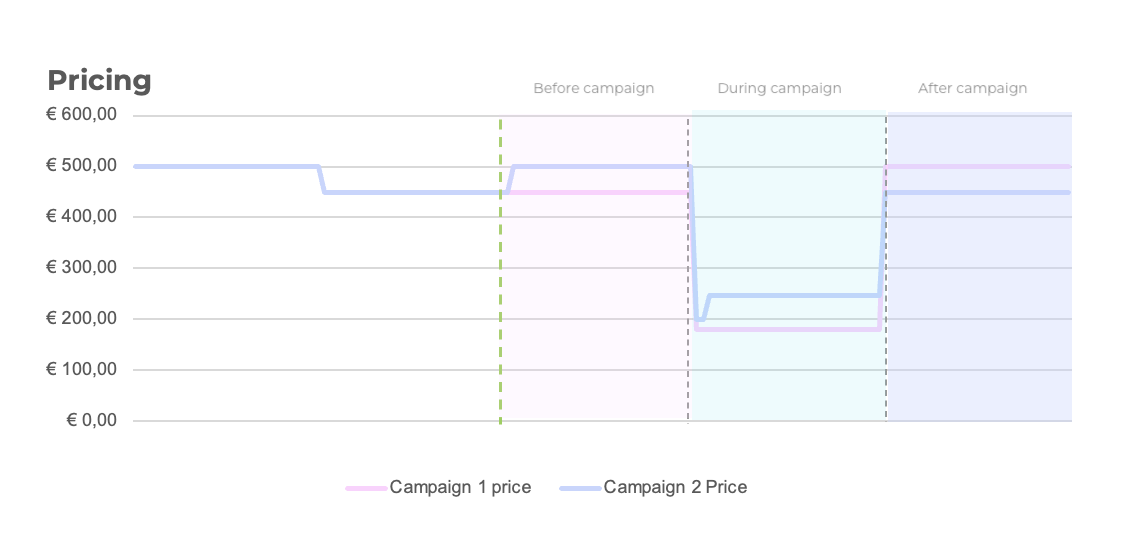

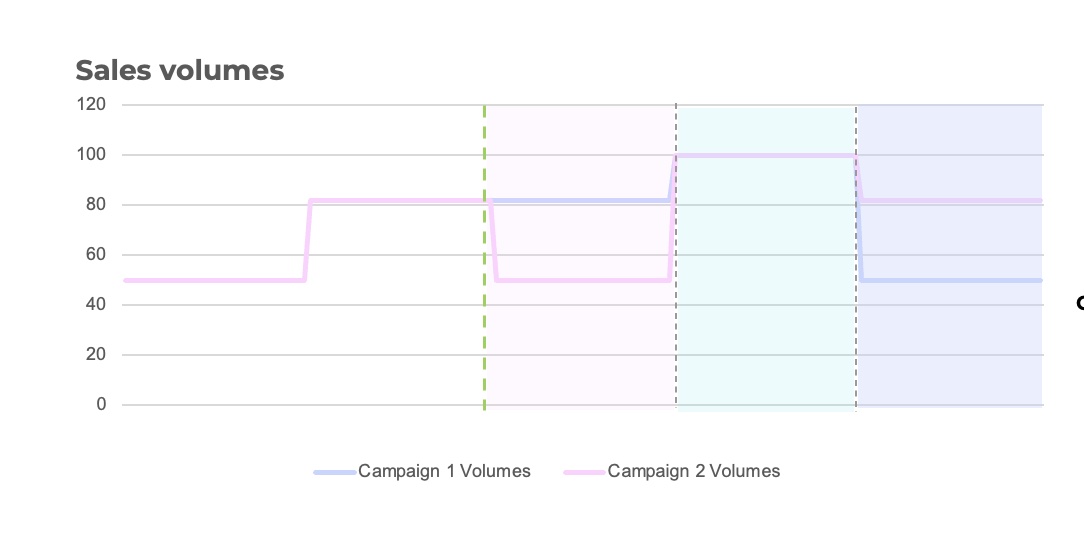

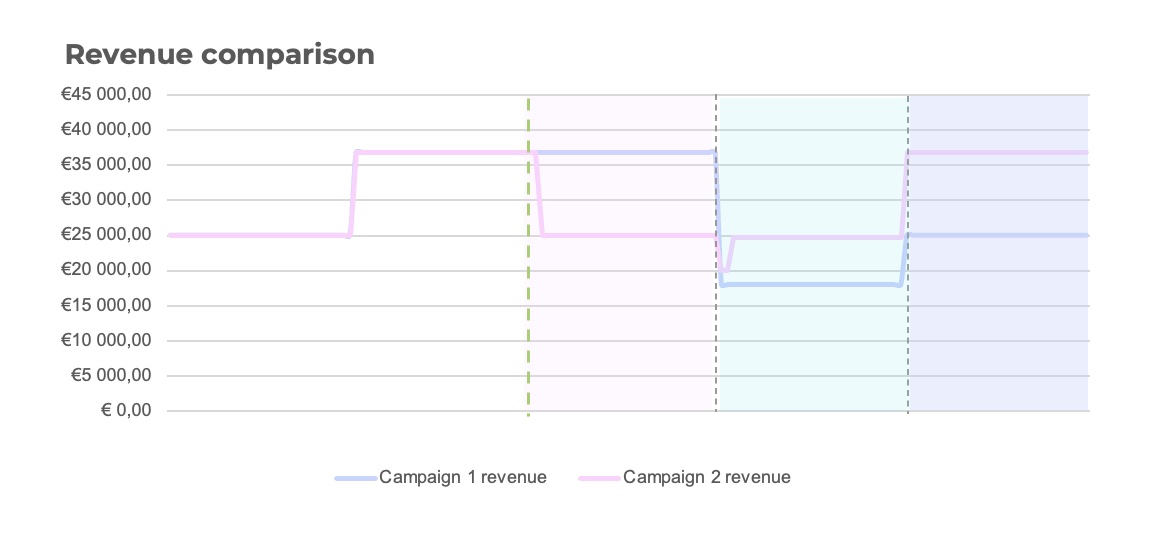

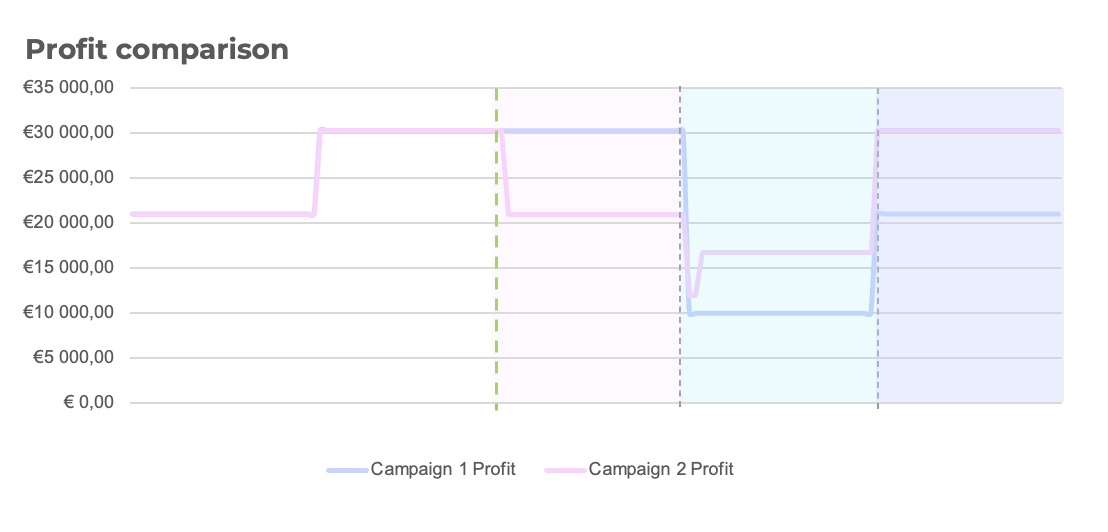

Eventually, we analyze the results between the scenarios with detailed analyses and see how revenue and profit develop at each stage. To make this visually clear we highlighted the three 30 days periods with different colors. The areas are:

Lighter pink

30-day period before the campaign.

Green

30-day campaign period.

Purple

30-day period after campaign.

So let’s start.

Ensuring Price Display Compliance

Make sure to adhere to the Omnibus Directive when reducing the price of your products.

Determine the market for Light Wooden designer chair

As we are selling a Light Wooden designer chair, the market we are in is price sensitive (see above for the reasoning). Our customers value the price, but it’s not the only criteria they consider. They appreciate fast delivery, which we are known for. So the price sensitivity is set to the second highest level. While using our campaign pricing simulator, you can always change the demand for both scenarios.

Setting the 30 day price before the sale

As the price is now 450€, we need to determine the strategy for both scenarios. To see how we perform, we create two highly different techniques. Scenario 1. is built on the expectation that a very high sale discount % will help us create a good campaign and get new customers for our customer pool. So for scenario 1. we raise the price to 500€ (a 50€ increase).

For scenario 2. we remain at the 450€ level. The ration behind this approach is that we have higher volumes before the campaign. That way we make a more constant flow of customers to our shop.

| Table 1. Price set before campaign | Scenario 1. | Scenario 2. |

| Price set Before Campaign | 500,00 € | 450,00 € |

Finalising the sale price and sale discount %

Now that we have raised scenario 1. price to 500€, we even have the legal right to compare the price to the original launch level ie. 500€. This will give us a higher levy for setting the sale % in the campaign.

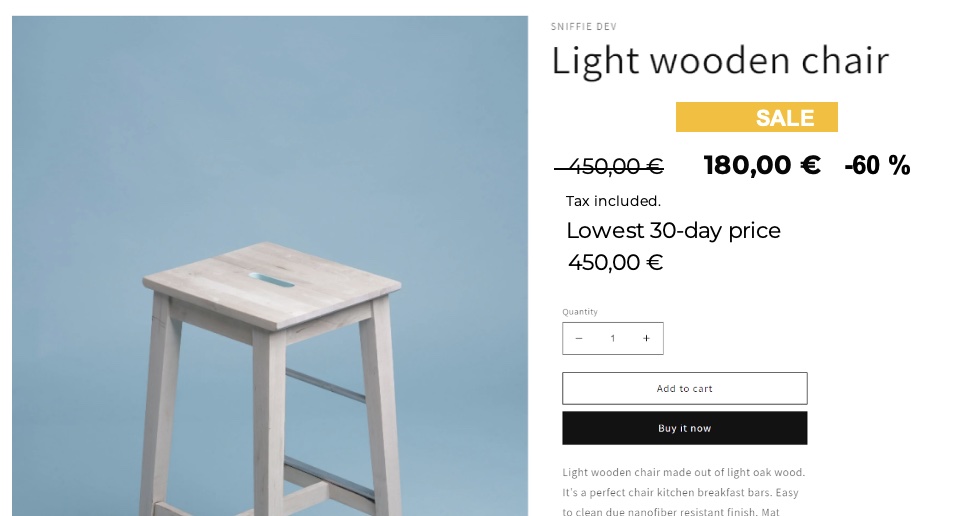

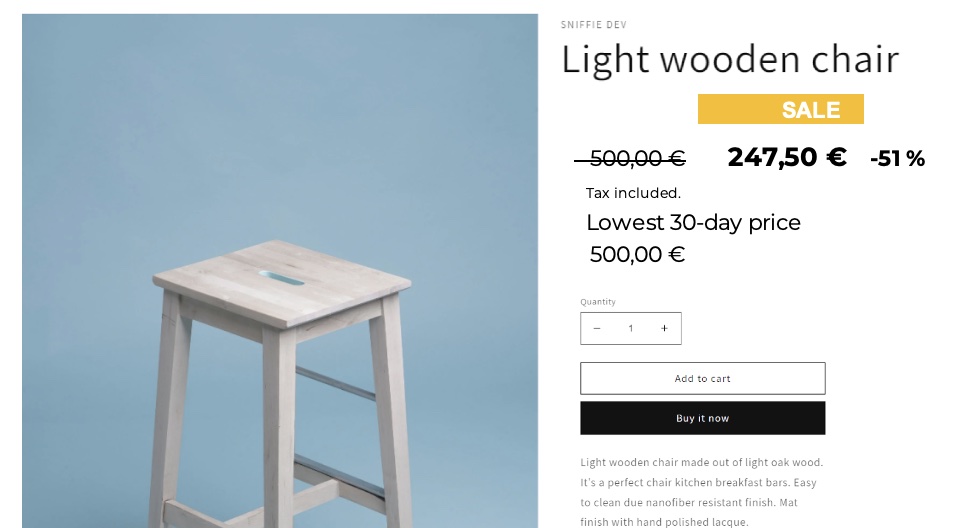

Our purchase price is 80€ for both scenarios, so the discount % can be fairly high in both cases. For scenario 1. we set the discount to 60%. That is a very high discount. For scenario 2 we set the sale discount to 45%. It is higher than 30% and in the expected line with the market pricing. See the sale campaign details from the below table.

| Table 2. Sale Campaign details | Scenario 1. | Scenario 2. |

| Campaign Discount % | 60 % | 45 % |

| Sale price | 180 € | 247,50 € |

| Comparison prices | 450 € | 500 € |

| Lowest 30-day price | 450 € | 500 € |

| Savings % | -60 % | -51 % |

Returning to normal pricing after campaign

As we now have good sales volumes and profitability of 450€ level, we decided to try out how our simulation works if in scenario 1. we raise the price to 450€ and in scenario 2. to 500€. Below you can find the returned prices.

| Table 3. Sale price comparison | Scenario 1. | Scenario 2. |

| Sale price | 450 € | 500,00 € |

The outcome of the sale scenarios

With these settings, scenario 2. will win with an overall 6% profitability ratio, although scenario 1. outperforms scenario 2. with a whopping 34% profit difference before the campaign. The campaign performance of campaign 2 is 64% higher than scenario 1. when we compare the profits. On revenue, the difference is 34%, which is also high. Lets dive deeper in the analytics.

| Table 4. Detailed analyses | Campaign1 | Campaign2 | Difference | Difference % |

| Overall Revenue | 4 378 524 € | 4 586 132 € | 207 608 € | 5 % |

| Revenue Before Campaign | 1 189 080 € | 764 636 € | -424 444 € | -36 % |

| Profit Before Campaign | 977 685 € | 641 589 € | – 336 095 € | -34 % |

| Campaign Revenue | 540 000 € | 732 972 € | 192 972 € | 36 % |

| Campaign Profit | 299 999 € | 492 981 € | 192 981 € | 64 % |

| Overall Profit | 3 482 779 € | 3 687 350 € | 204 571 € | 6 % |

Use our sale price planning tool

Are you interested to know what is the best on sale price for your next discount campaign? Is raising the price before the campaign wise? To know it, try out our latest tool Discount Campaign Pricing Simulator and play with two scenarios and real-life demand.

Visual difference on the product pages

Analyzing the results to understand why the difference is so high

The simple answer for the difference is that we were too eager to give a discount in scenario 1., although our customers are price sensitive. A 60% discount is enormous, even too high. But even if we started from 500€, 60% eats most of our profits during the campaign. Anything above 50%, is most likely too much for your profits.

For example, setting the deal in scenario 1. to 50% would have narrowed the gap to 2% on overall profitability. Moreover, putting the final price to 480€ for scenario 1. would mean that scenario 1. would win with an overall 2% and 70 139€ difference.

This example shows well that, when planning a campaign, it is too luring to higher prices before the sale and to set high discounts, even if you have price-sensitive customers.

Naturally, every case is different, and only you can know the actual impact on your customers. That said, using clear and comprehensive scenario calculations for your campaign will help you create profitable deals in your next discount campaign.

Notice that even you are human. Thinking that a high discount percentage will make the best results might be psychologically biased. Therefore we suggest you use this type of exercise to help your decision-making. Enlighten your team about the outcomes, even on a example product like this.

We uploaded the Excel tool we used to our Resource Library to help you make decisions. You can also download our price elasticity tool to know what kind of customers you are serving. Here is a list how you do the same scenario by yourself.

- Download the tools

- Calculate your customers price elasticity

- Use that as a basis in the scenarios

- Play the scenario in our Excel tool

Hopefully it will help you to make more informed decisions.

Use our FREE tools from Resource Library

Are you interested to know what is the best price for your next discount campaign? Is raising the price before the campaign wise? To know it, try out our latest tool Discount Campaign Pricing Simulator and play with two scenarios and real-life demand.