Intro

Today we are heavily relying on eCommerce stores where we can easily find the bottom price. If you are on one website looking for something to buy, you might also find the same product on another website where it is cheaper. This is where the concept of price matching comes in.

To put it short price match refers to you matching your pricing to competitors pricing. The method often includes also an offline opportunity to prove your possibility for a lower price. The price match is often used by retailers, yet it is a controversial strategy where consumers in the end might be loosing as competitors are unwilling to lower prices.

Price matching and Price adjusting are not the same thing

Price matching and price adjustment may sound and seem alike but the two are separate concepts, yet retailers are known to use them interchangeably.

Price matching as explained above is when a retailer drops the price of a product should a customer notifies them that a competitor is selling the same one at a lower price.

Price adjustment on the other hand is when a retailer will lower their prices and if a customer has bought the product within specific time period, would be eligible for a difference refund.

Who is it for?

Large and recognized companies such as Best Buy use price matching policies to beat their competition and get more customers.

Best Buy’s Price Match Guarantee states that the company will not be beat by price as they will “Match the product prices of key online and local competitors for immediately available new products (excludes clearance, refurbished and open-box items).” However, Best Buy does not offer the price match for every product but only for products that are of the same brand, model number and color to that they sell.

Read the complete story on pricing strategies

Read the complete story on pricing strategies

Important considerations

Never ignore your margins

A price match policy is great and sounds awesome to your customers but that also doesn’t mean that you ignore your profit margins. You need to rationally evaluate whether you can match your competitor’s price.

There are variety of things to consider – do you have the cushion necessary to drop your prices? Does your cost of purchasing allow you to give refunds to your customers? The biggest concern is that you can never control your competitor’s pricing. What if your competitor decide to lower prices even further? Would you still be able to match these lowered prices?

You certainly don’t want to be in a situation where you cannot match the price and lose your customers.

What makes you different?

Here’s an example you need to consider – two retailers (A and B) have the price matching policy in place. A customer goes to the first and sees that a product is priced higher compared to the other one. Now ask yourself – why would the customer choose the retailer B with the lower price since he can use price matching to get it at the same price from retailer A.

Here’s why you need something to be different from your competitor. Price matching can work but it also needs a unique offering along with it. For instance if a customer comes to you, offer them free shipping, future discounts or maybe gift vouchers. It’s important to make your price matching policy something that stands out from the competitors.

Be careful with rules and policies

It’s important that you spend some time in drafting the policies and rules for your price matching offering. Salient restrictions can include online versus in store products, discounts and limited promotions not included in the scheme etc.

If you want to know how important it is to have proper rules and polices, head back to Best Buy’s price matching policies section to see how detailed it is. Study how they wrote it and how you can use it in your own retail practices.

Competitive match pricing methodology

Offering the exact same price as your competitor puts the customer to an evaluation situation. In this situation customer compares your product with your competitor’s product and probably chooses the one which gives more value for the price. Competitive match pricing methodology means changing prices according to market changes. By using competitor pricing as a basis of setting and changing pricing according to market pricing. This method keeps our prices competitive but also leaves room for error when price premium might me available.

You can also price your product below the price your competitor offers. This setting is interesting to the customer but creates risk to your business. That is why you need to be careful when pricing below competitor prices. Always evaluate the situation accordingly, because this method might bring in negative cash flow.

The last thing you could do is price the product above what your competitors charge. There are two things you need to consider when implementing this method: customer probably expects more value of your product or service, since your product costs more than the one of your competitors. And you must make sure you can answer to these customer expectations, since if you don’t, you lose your customer to your competition.

Dos and don’ts of price matching

Never break your promises

The worst thing you can do when it comes to price matching is not honoring it. If a customer has chosen you to purchase something and wants a price match with another retailer, you should do it if you have the offer in place.

Customers don’t like false advertising and if you promote price matching on your products and don’t honor it when someone comes in for it, you are going to lose customers and generate negative word of mouth against your business.

Remember, it is wise to lose few bucks on a sale than to create a negative reputation. Customers will show their anger by their feet as they move towards your competitors who are offering better price matching offers.

Remember to monitor and measure

As retailer you need to measure and test your policy from time to time. Just because you started it doesn’t mean you can rest easy. Some retailers enjoy great results while others don’t.

Knowing early on that your policy is hurting your business can help you nip it in the bud and start afresh. Check whether sales are going up or if customers are coming in due to your price matching policies. Basically, you need to know whether its profitable for you or not to have a price matching policy in place.

Price matching is a double edged sword – if you want to work around price, then you will have to go to the bottom since that’s what price matching does. While for some retailers this might be a feasible strategy, for others, it might not be.

Related content

We highly recommend you to read our other articles related to pricing strategies! 😎

5 ways to use data and pricing tools to predict and plan for Black Friday success

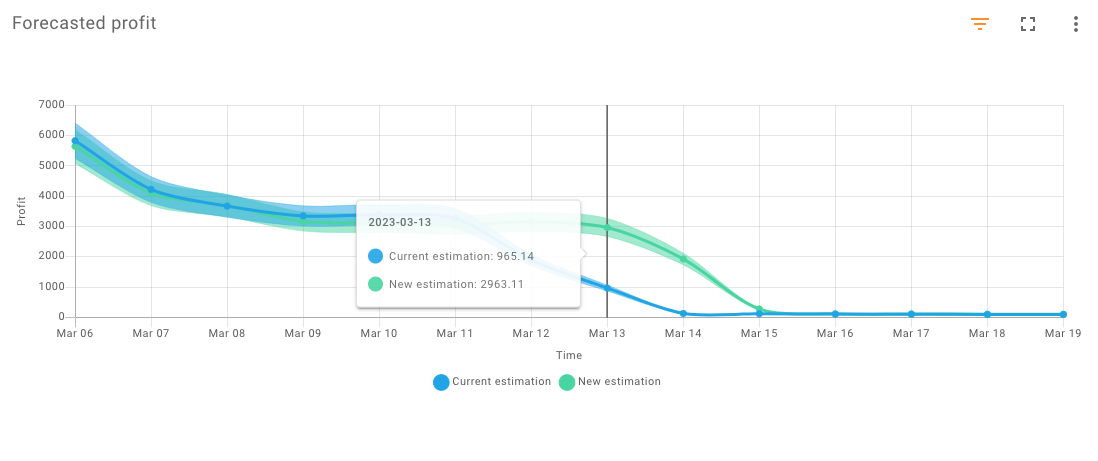

New: Compare pricing scenarios before setting prices live

Motonet strengthens strategic pricing operations across the Nordics with Sniffie

Shopify Meetup Helsinki – Boosting Profits with Shopify Plus: Mastering Margins

Price Matching: 4 Benefits and 4 Disadvantages

Pricing psychology: Understanding how consumers perceive and respond to pricing

Best practices for implementing eCommerce pricing software on Shopify

3 key metrics to set targets for a discount campaign

The pros and cons of dynamic pricing for your Shopify Store

Liquidating excess inventory: how discount campaigns can help

The 4 most common pricing mistakes Shopify store owners make and how ecommerce pricing software can help avoid them

Using Discount Campaigns to boost sales and increase customer loyalty

Why master data is crucial – and what a good master dataset looks like

Maximizing Profits with AI: Forecasting and Price Simulation

What is a cost and how do different costs affect your pricing?

How do you calculate a purchase price for a product for an optimum outcome?

What’s ahead for eCommerce in 2023?

Guide to a Pricing Strategy during High Inflation

Introduction to Pricing Strategies

Premium pricing strategy